On April 11, 2020, the federal government passed Bill C-14 (A second Act respecting certain measures in response to COVID-19; the “Act“) which amended the Income Tax Act to implement the 75% COVID-19 emergency wage subsidy first announced by the government on March 27, 2020.

On a high-level basis, the Act provides a 75% wage subsidy (up to a maximum of $847 per week) to employers in respect of employees that continue to be employed during the crisis. As always, however, the devil is in the details and a careful examination of the legislation is needed to determine whether any given employer will qualify for the subsidy.

Which Employers qualify for the wage subsidy?

An eligible employer includes individuals, taxable corporations, partnerships consisting of eligible employers, non-profit organizations and registered charities.

How does an Eligible Employer qualify for the wage subsidy?

The subsidy will be provided over 3 qualifying periods of 4 weeks each, commencing March 15th and ending on June 6th (with the possibility of the program being extended up to September 30th by regulation). For the first qualifying period (March 15 to April 11) the employer’s qualifying revenue for March 2020 must be at least 15% less than its qualifying revenue for March 2019; for the remaining two qualifying periods (April 12 to May 9 and May 10 to June 6) revenue must be at least 30% less (comparing revenues from April 2020 to April 2019 and from May 2020 to May 2019, respectively).

Alternatively, an employer may elect to compare their March, April and May 2020 revenues against the average monthly revenues earned in January and February 2020, to account for more recent startups where revenues have increased rapidly over the past year (although such election is available to any employer provided that such employer similarly elects for all qualifying periods).

It should also be noted that, regardless of which method is used to compare revenues for a given qualifying period, the Act specifies that an employer that meets the revenue reduction requirement for a given qualifying period is also deemed to have met this requirement for the immediately following qualifying period. This means that an employer that meets the 15% reduction requirement for the March 15 to April 11 period will also be deemed to have met the 30% reduction requirement for the April 12 to May 9 period. Such an employer would, however, need to meet the 30% reduction requirement in either the April 12 to May 9 period or the May 10 to June 6 period in order to qualify for the wage subsidy in the May 10 to June 6 period.

In addition, the following conditions must be met:

- the employer files an application with the Canada Revenue Agency (the “CRA“) in respect of the qualifying period in prescribed form and manner, before October 2020;

- the individual who has principal responsibility for the financial activities of the eligible entity attests that the application is complete and accurate in all material respects, including the required decline in revenue; and

- the employer had, on March 15, 2020, a payroll number with the CRA for making employee source deductions.

What does qualifying revenue mean?

Qualifying revenue has been defined to include the inflow of cash, receivables or other consideration arising in the course of ordinary activities of the eligible entity, which is generally from the sale of goods, the rendering of services and the use by others of resources of the eligible entity in Canada, in the particular period.

Qualifying revenue excludes:

- extraordinary items;

- amounts derived from persons or partnerships not dealing at arm’s length with the eligible entity; and

- deemed overpayments and deemed remittances.

How is revenue determined?

The qualifying revenue of an eligible employer is determined in accordance with its normal accounting practices, subject to certain exceptions noted below:

- if a group of eligible entities normally prepares consolidated financial statements, each member of the group may determine its qualifying revenue separately, provided every member of the group determines its qualifying revenue on that basis;

- if an eligible entity and each member of an affiliated group of eligible entities of which the eligible entity is a member jointly elect, the qualifying revenue of the group, determined on a consolidated basis in accordance with relevant accounting principles, is to be used for each member of the group;

- if all the interests in an eligible entity are owned by participants in a joint venture, then the qualifying revenues of the joint venture may be used; and

- if more than 90% of an eligible entity’s qualifying revenue is derived from one or more related persons or partnerships, the entity is subject to a special calculation to determine its eligibility provided all parties elect. In this case, the eligible entity essentially is deemed to prorate the decline in its revenue based on the decline in the arm’s length revenues derived by the related persons or partnerships. This election may prove useful in many cases such as, for example, in the case of a services partnership which only provides services to a professional partnership through the provision of staff and leased premises (a relatively common form of structure for professional firms).

What is the amount of the wage subsidy?

The wage subsidy is calculated for each eligible employee (see definition below) on remuneration paid in respect of a week in the particular qualifying period and is essentially equal to 75% of the eligible remuneration paid in respect of the week up to a maximum of $847 (provided that, if the employee does not deal at arm’s length with the employer, the amount cannot exceed 75% of such employee’s baseline remuneration (see definition below); such restriction prevents a non-arm’s-length employee from artificially increasing their remuneration eligible for the subsidy). The subsidy is also reduced by any amounts received by the employer pursuant to the previously-announced 10% wage subsidy as well as through the EI program’s work-sharing benefit. It should also be noted that the use of the phrase “in respect of a week” makes it clear that the date of payroll is not a determining factor when calculating amounts paid for a week.

Baseline remuneration is defined as the average weekly eligible remuneration paid to the eligible employee by the eligible entity during the period that begins on January 1, 2020, and ends on March 15, 2020, excluding any period of seven or more consecutive days for which the employee was not remunerated.

Eligible employee means an individual employed in Canada by the eligible entity in the qualifying period, other than an individual who is without remuneration by the eligible entity in respect of 14 or more consecutive days in the qualifying period. This means that employees who were laid off in a particular qualifying period must have been laid off, without remuneration, for less than 14 days during such period.

Any amount received in respect of the wage subsidy is deemed to be government assistance, and therefore will be included in the recipient employer’s taxable income for the qualifying period to which it relates.

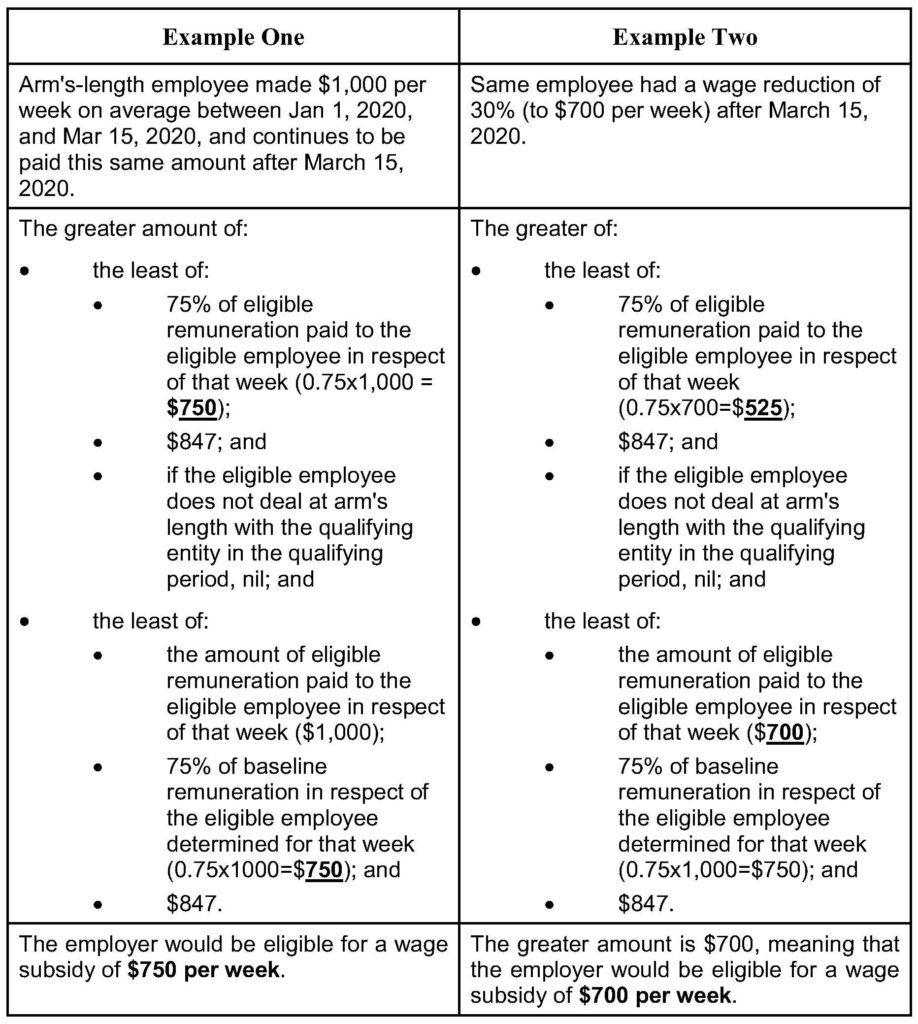

Wage Subsidy Example:

The wage subsidy is equal to the greater amount of:

- the least of:

o 75% of eligible remuneration paid to the eligible employee in respect of that week;

o $847; and

o if the eligible employee does not deal at arm’s length with the qualifying entity in the qualifying period, nil; and

- the least of:

o the amount of eligible remuneration paid to the eligible employee in respect of that week;

o 75% of baseline remuneration in respect of the eligible employee determined for that week; and

o $847.

What are the penalties for not complying with the wage subsidy rules?

The employer will be required to repay amounts paid under the Canada Emergency Wage Subsidy if they do not meet the eligibly requirements. Penalties may apply in cases of fraudulent claims, which may include fines or imprisonment. Employers that engage in artificial transactions to reduce revenue for the purpose of claiming the subsidy will be subject to a penalty equal to 25% of the value of the subsidy claimed in addition to repaying the full amount of the subsidy that was improperly claimed. Although the government has stated that it expects employers who receive the subsidy to use their best efforts to “top up” the subsidy for the 25% of eligible remuneration not covered by the program, the legislation does not contain any specific penalties or other enforcement mechanism in that respect.

Refund for payroll contributions

Employers are also entitled to a full refund for employer-paid contributions to Employment Insurance and Canada Pension Plan. The refund covers 100% of these amounts for each week throughout which an employee is on leave with pay and for which the employer is eligible to claim the wage subsidy for that employee.

If you have questions about the federal wage subsidy, please contact a member of the employment group or the tax group at Fogler, Rubinoff LLP.