On September 25, 2020, Health Canada published the results from its consultation “Potential Market for Cannabis Health Products (CHPs) that would not Require Practitioner Oversight“, which took place from June 19 to September 3, 2019. The consultation sought feedback from the Canadian public and industry on a new category of cannabis products, referred to as cannabis health products (“CHPs”).

Currently, health products containing cannabis may only be sold to individuals with a prescription from a healthcare practitioner, such as a doctor or veterinarian. Eliminating the need for healthcare practitioner oversight is expected to lead to easier access, improved product selection, and wider acceptance of health products containing cannabis.

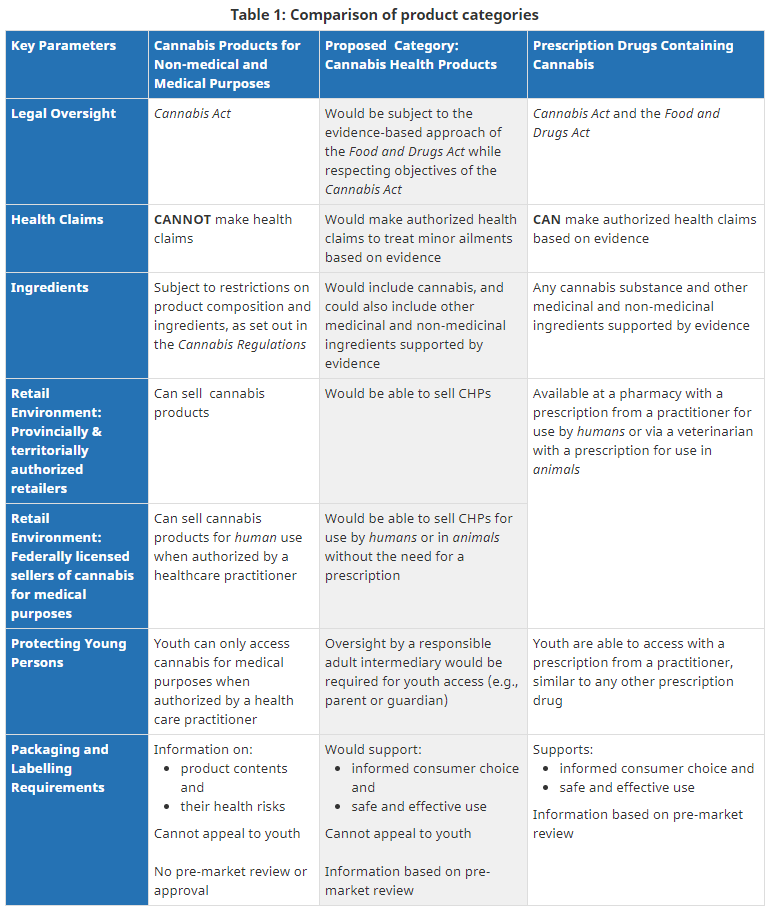

In connection with the consultation, Health Canada outlined key parameters for the proposed CHP category, which included details regarding legal oversight, health claims, ingredients, the retail environment, protecting young persons, and packaging and labelling requirements. Details on the key parameters outlined by Health Canada’s can be found in Appendix “A” of this article.

Consultation Results

The consultation received 1,104 responses from consumers interested in purchasing CHPs (62%), industry representatives interested in manufacturing or selling CHPs (23%), and other interested parties (15%), such as healthcare professionals and researchers. Additionally, Health Canada received written submissions by various interested organizations and associations.

Consumer Responses

Industry should take comfort in the positive attitude of consumers towards CHPs. Consumers were asked questions relating to their interest in purchasing CHPs, desired uses, preferred product formats, and were also invited to provide additional comments. Their responses are summarized as follows:

Interest in Purchasing CHPs: Responses were overwhelmingly positive, with 93% of consumers interested in purchasing or learning more about CHPs to treat minor ailments. Many respondents stated they view cannabis as a natural remedy, and believe it to be safer or healthier to use than pharmaceuticals.

Common Themes for Use: Consumers are interested in CHPs for pain relief and inflammation (such as joint or back pain, arthritis, migraines or headaches), as well as mental health issues (such as anxiety, depression and stress). Consumers generally felt that Canadians would benefit from having access to CHPs deemed safe by Health Canada.

Preferred Product Formats: Consumers expressed interest in having a wide variety of product formats available. Strongest interest was for oral products (extracts, tinctures, oils, capsules or sublingual formats), followed by topicals (creams or lotions), edibles and beverages. Approximately a quarter of consumers were interested in all formats / had no preference, and 10% prefer to continue smoking or vaping cannabis.

Regulatory Preferences: Of consumers providing additional feedback, 40% agreed that CHPs require appropriate regulatory controls, however, consumers stated regulations should support access and informed decision-making. Notably, consumers also supported the general industry view that CBD should be regulated differently to other products or substances, such as THC.

Preferred Retail Environment: Some consumers suggested implementing a retail environment similar to over-the-counter drugs or natural health products. Many suggested they would prefer access to produ cts without additional practitioner oversight.

Industry Responses

Despite the slow rollout of this product category, strong industry interest continues to exist for manufacturing, marketing and selling CHPs for both human and animal applications. Industry was asked to discuss what type of formats, cannabis ingredients, and related health claims they would make. Close to half of industry respondents indicated a specific interest in CBD-based products. With respect to product formats and health claims, industry is on point with meeting consumer demands. Industry expressed interest in manufacturing the same product formats mentioned by consumers, and making health claims related to pain relief and inflammation, as well as sleep disorders and anxiety — areas consumers expressed the most interest in.

Industry was asked whether certain elements of Health Canada’s proposed approach would create incentives or disincentives to the CHP market. As expected, industry supported Health Canada’s proposal to offer CHPs without the oversight of practitioners. Also as expected, industry opposed Health Canada’s proposal to restrict the sale of CHPs to provincially and territorially authorized retailers or federally licensed sellers, listing this as a major disincentive. Approximately 40% of industry respondents recommended CHPs be sold in pharmacies, veterinary clinics or health stores. With respect to packaging and labelling, industry expressed preference for packaging and labelling that was more in line with natural health products or over-the-counter drugs.

Unsurprisingly, many industry respondents took this opportunity to urge Health Canada to regulate CBD differently from THC — unfortunately, this was not elaborated on further by Health Canada.

Responses by Other Interested Parties

Other interested parties comprised various groups such as healthcare and veterinary professionals or associations, academics, researchers, government organizations, non-governmental organizations and regulatory advisors.

Conclusion

The completion of the consultation marks another small step towards the introduction of CHPs in the Canadian marketplace. That said, there is still a long road ahead. Health Canada advised that they intend to create a scientific advisory committee in 2020 for further advice relating to CHPs. Accordingly, industry and consumers will need to remain patient until the details surrounding this new category are formalized.

Schedule “A”